With so much of our money existing on our phones these days, it can be near impossible to keep track of where and how much you’re actually spending. Whilst you can certainly budget by creating a spreadsheet or using more traditional, physical methods – using budgeting apps could be the key to getting your spending on track in 2024.

Here’s a rundown of all the best budgeting and money-saving apps that you can download.

01

Buddy

Buddy is a Swedish app that allows you to budget and track your spending. Unlike other apps, you can use Buddy without connecting your bank accounts. Whether you want to keep track of personal spending or finances in a relationship, Buddy will give you a clear snapshot of your habits. Not only this, but the app can also be used with friends on a holiday to keep track of who has spent what.

02

GoodBudget

GoodBudget is an app that relies on the traditional envelope budgeting system. Envelope budgeting works by dedicating envelopes to a category such as groceries, bills, takeaway. Then you fill the envelope with a set amount of money you plan to spend on each category. GoodBudget takes this method online to help you visualise where your money goes each month.

03

You Need a Budget (YNAB)

You Need a Budget has been hailed by users and experts alike for its budgeting and money-saving abilities. Rather than using a more traditional bucket method, YNAB opts for a “zero-based budgeting system” instead. Essentially, this method means that by the end of your pay cycle no dollar is unaccounted for – whether that’s due to bills or short/long-term saving goals.

04

WeMoney

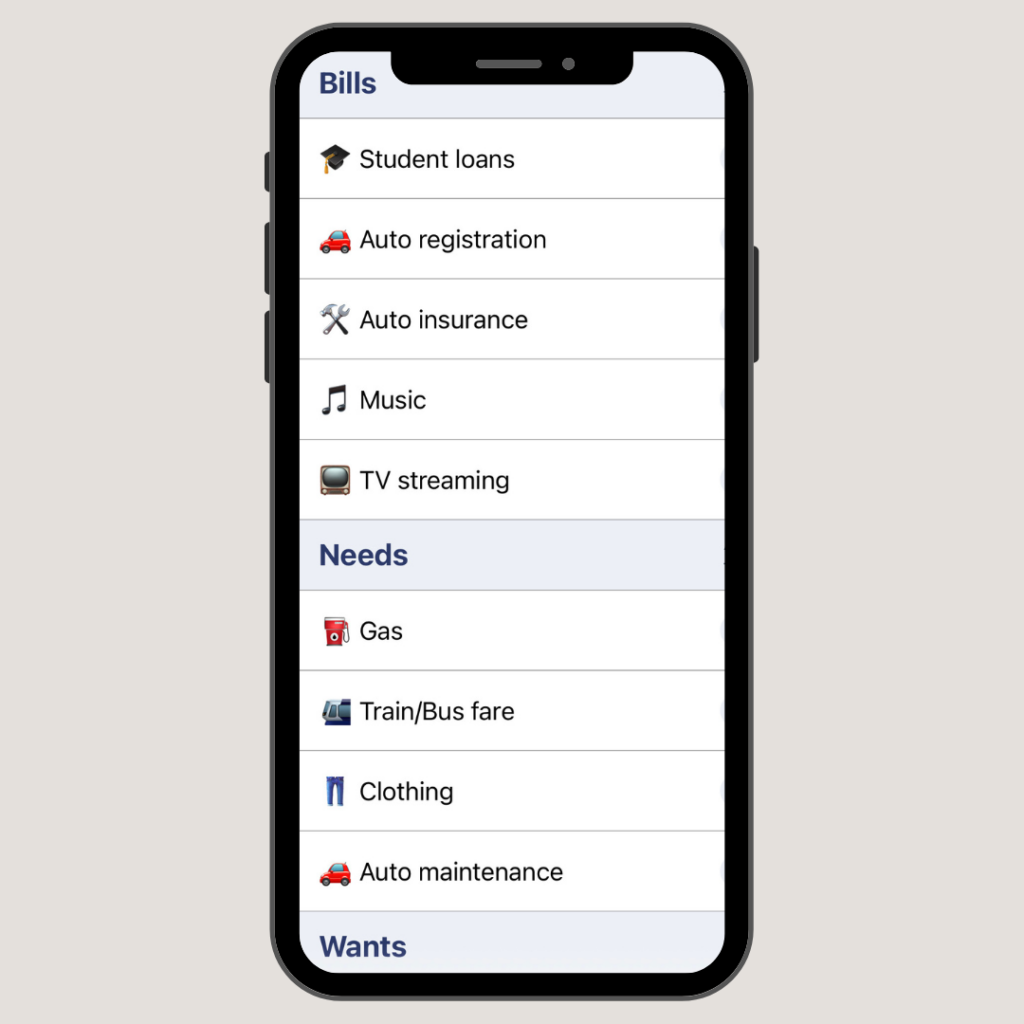

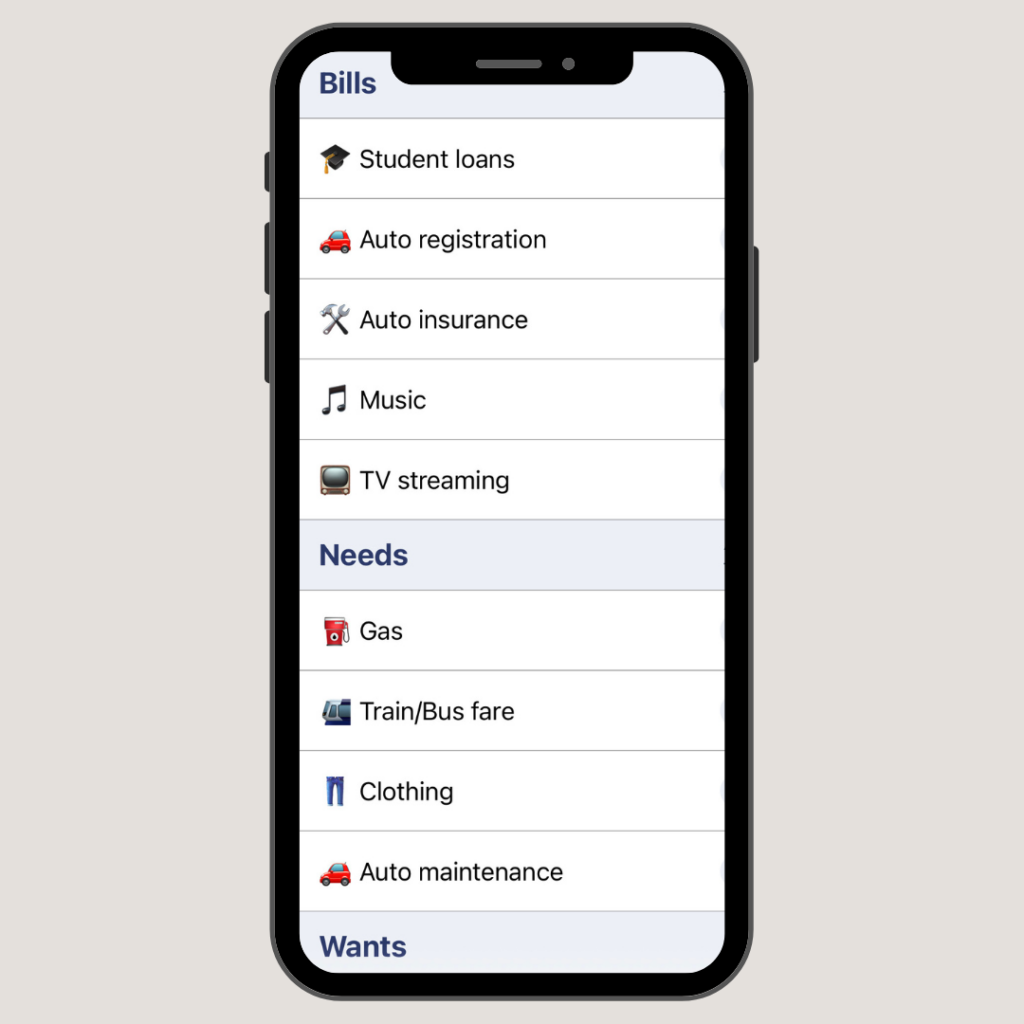

WeMoney promises to give you a 360-degree look at your finances. The app allows you to connect savings, loans, credit cards, super, buy now, pay later, investments and cryptocurrency assets so you get a full understanding of your financial position and spending.

The app also allows you to categorise your transactions, keep on top of recurring bills and subscriptions as well as set monthly budgets and goals for the future.

04

Your banking app

If you’re hesitant to use a third-party app, why not see if your bank has its own budgeting capabilities or dedicated apps. For example, Commbank has a spend tracker within their banking app where you can categorise transactions and get a snapshot of your spending habits.

NAB also have an in-built spending tracker that breaks down exactly how much money you spend on bills, shopping, groceries and other categories each month.